How to implement an ESG strategy with OKRs

More and more people want to know how the companies they buy from or invest in care for the environment or position themselves on certain social issues. Companies can therefore no longer afford to exclude areas such as sustainability, social responsibility, and (ethically correct) corporate governance – ESG (Environmental, Social, Governance) for short – from their strategies. Instead, they should develop targeted strategies that address these socially and ecologically relevant issues.

In this article, we take a closer look at what ESG is all about, why these three letters are so important for companies, and how an ESG strategy can be implemented with OKRs.

What to expect:

- What is ESG?

- Why is ESG important for companies?

- What are the challenges in ESG strategy development?

- Why should you use OKRs for ESG strategy?

- Implementing an ESG strategy with OKRs: Here's how

- OKR examples for ESG

- ESG strategy: FAQ

What is ESG?

The abbreviation "ESG" stands for Environmental, Social, and Governance and describes the main requirements that companies should fulfill in terms of sustainability, ethics, and social responsibility.

ESG originated in the financial industry as a collective term for a sustainable investment approach. The ESG criteria are intended to ensure that organizations act sustainably and can also be held accountable for their corporate actions. In short, they create social and environmental liabilities for companies, making it easier for investors to see what their investments are worth. The criteria go beyond traditional financial indicators, as they enable a broader assessment of investments.

Environmental

This criterion covers all the effects that a company's actions have on our environment, as well as its contribution to environmental protection. Relevant areas include the following:

- Waste and environmental management

- Resource management

- Greenhouse gas emissions (GHG)

- Air pollution

- Energy efficiency

- Deforestation

Social

Here, we assess how a company behaves towards people. This includes its own employees as well as external stakeholders (e.g. customers or the public). Important aspects are:

- Diversity, equality, and inclusion

- Working conditions

- Data protection and privacy

- Customer satisfaction

- Health and safety

- The local community

Governance

The governance factor encompasses how a company is managed and how well it regulates its own actions. Among other things, this includes:

- Tax strategies

- Manager salaries

- Corporate structure

- Donations and lobbying

- Corruption and bribery

- Diversity on boards of directors and supervisory boards

Why is ESG important for companies?

Today, companies have an increasing obligation to act sustainably. Much of society now values well-known brands that address social and environmental issues and position themselves clearly. Investors and executives are also paying more attention to sustainability and ethics: ESG-oriented investments are experiencing a real boom, according to a study by McKinsey & Company. Around the world, 30 trillion U.S. dollars are now flowing into ESG-oriented issues.

However, it is not only social responsibility that drives companies to address ESG issues. The investments are also worthwhile for the company's own (financial) future: Those who implement a good sustainability strategy today will have a considerable competitive advantage when stricter regulations take effect in the future.

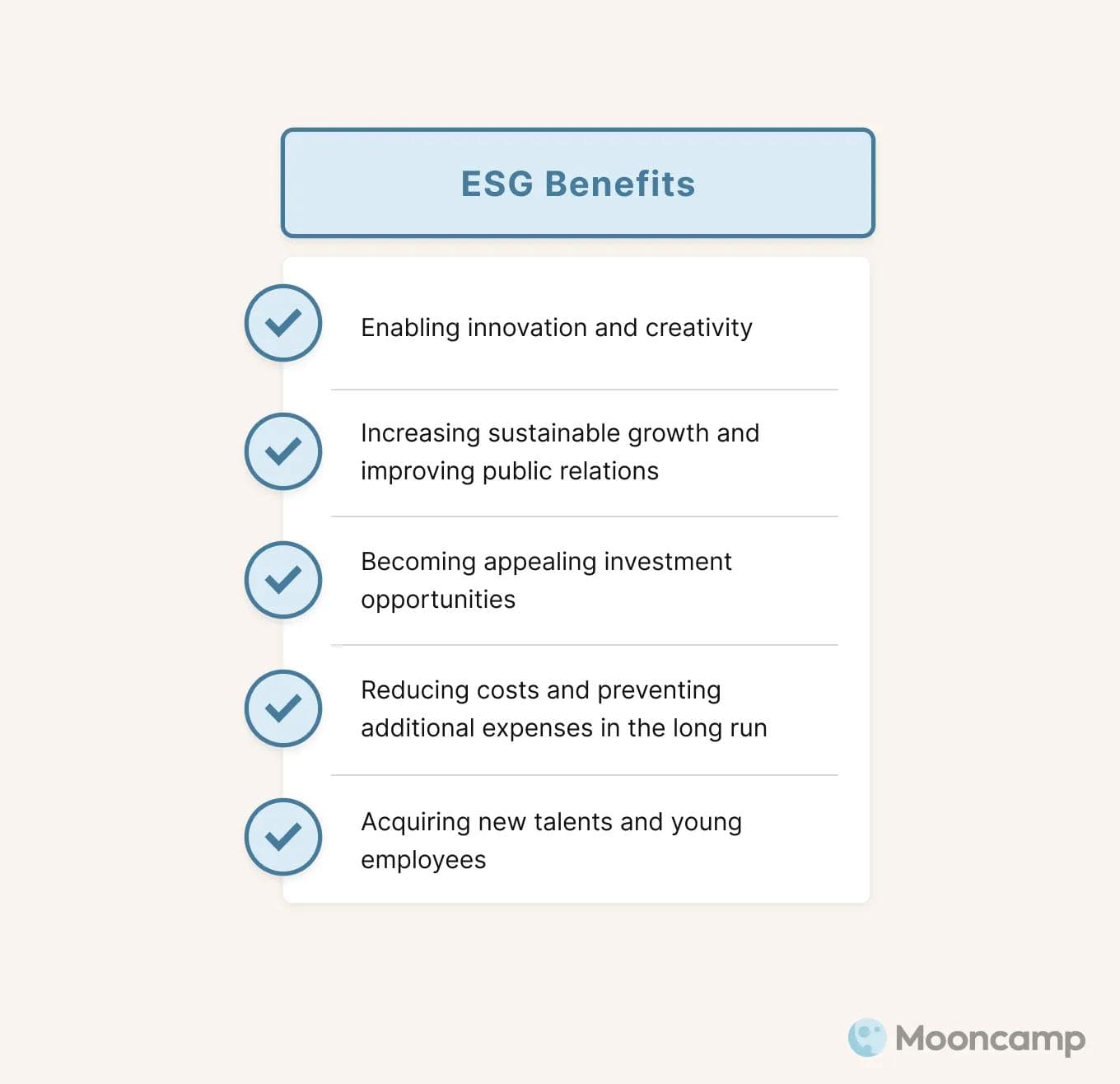

So all in all, a well-thought-out ESG strategy offers numerous advantages. The most important ones are summarized here:

- More innovation: Implementing ESG criteria can be a real challenge, depending on the industry. At the same time, however, ESG also offers the opportunity for innovation. Instead of seeing the requirements as an inconvenience, companies should take the opportunity to get creative and develop new environmentally friendly business models and products with greater social impact.

- More growth and entrepreneurial opportunities: Younger generations (Millennials and Gen Z) in particular are showing increased social and environmental awareness. They are using their purchasing power to reward companies that embrace ESG criteria. Gen Z in particular is willing to spend up to ten percent more on sustainable brands. On the other hand, those who fail to meet their ESG commitments are penalized. This makes the ESG strategy an essential part of branding and public relations. It also has a direct impact on sales and can make a difference in the marketplace between a company's sustainable growth and its rapid disappearance.

- Better investment opportunities: So-called "impact investing" is becoming increasingly popular. Companies with strong ESG initiatives tend to be safer long-term investments. They are less likely to be fined or regulated and focus on new sustainable technologies.

- Less cost: Neglecting ESG can lead to large fines and compensation, strikes, or plant shutdowns. Addressing this early will save these costs. Additionally, sustainable processes and materials can help reduce company expenses in the long run.

- New talent: Young talents today are consciously looking for jobs that are meaningful. They want to work in companies whose values they can identify with. In the "war for talent”, a clear ESG strategy can therefore be a real advantage.

What are the challenges in ESG strategy development?

The biggest challenge regarding ESG is understanding the term correctly. Which specific topics and sustainability criteria are hidden behind the abbreviation is often not clear or uniformly regulated. Many companies are already implementing ESG measures without knowing it. For example, when they try to create optimal working conditions for their employees. But there is often no real strategy behind it. Yet a well-thought-out approach is essential if companies are to be truly fit for the future in terms of sustainable business practices.

ESG requirements should not be implemented hastily and arbitrarily. Instead, a strategy should be developed that is individually tailored to the company. Each organization can decide for itself which aspects are most important and have priority. Nevertheless, it is essential to consider current standards and legal regulations when making a selection. These can vary relatively widely by country and industry – and change over time. Companies must therefore be as agile as possible in their ESG efforts.

Keeping track of the many different standards, regulations, and topics as well as filtering out the most important measures and goals can be a daunting task. It is therefore all the more important to approach the matter step by step and to define a certain framework. In the next section, we will take a closer look at how OKRs can help.

Why use OKRs for ESG strategy?

The beginning of every good ESG strategy requires concrete goals (more on this later). OKRs can help identify the right ones among the multitude of topics and possible goals – and then implement the strategy as effectively as possible.

💡 Reminder: OKR (short for "Objectives and Key Results") is an agile framework for formulating and implementing strategic goals in companies that consists of three core elements:

- Objectives: What do I want to achieve?

- Key Results: How do I know that the goal has been achieved?

- Initiatives: How do I achieve the objective?

As a rule, 2 to 4 Objectives are formulated per team and 2 to 4 result-oriented Key Results per Objective. The output is mapped in initiatives (= concrete activities). More basic knowledge can be found in our OKR guide.

There are four main reasons that advocate the use of OKRs as a strategic framework for ESG initiatives:

- OKRs support transformative rather than incremental ESG goals. OKR goals are always set in such a way that they are ambitious. To achieve them, the team must think big and make impactful changes. This is precisely the mindset that is often needed to tackle ESG challenges, such as addressing climate change, eliminating social injustice, or creating fair working conditions.

- OKRs focus everyone on implementation. Ambitious goals are not only recorded as Objectives but are also translated into measurable, traceable milestones in the Key Results. They can therefore guide all employees throughout their day-to-day work and provide a clear common direction for implementation. Everyone sees how they contribute to the company's goals and what they are responsible for.

- OKRs close the gap in strategy execution. OKRs not only help define goals. By deriving concrete initiatives from OKRs, the framework also ensures that things actually get done and the teams stay on track. Additionally, OKRs help keep track of and prioritize ESG goals and initiatives within a certain timeframe.

- OKRs enable agility. Through short cycles and regular check-ins, the framework creates the necessary space to react flexibly to changes and find solutions to unforeseen problems.

💡 Tip: If you want to get a closer look at the benefits of the framework, you can find an overview of all OKR benefits on our blog.

Implementing ESG strategy with OKRs: Here's how

Let's now take a step-by-step look at how to develop and implement an ESG strategy using OKRs in practice.

💡 Note: Before using OKRs for ESG purposes, it is best to have already implemented and tested the method in the company for one or two cycles. Then it can be more easily applied to the somewhat more complex ESG issues.

Step 1: Identify challenges

How companies define ESG and especially sustainability for themselves can vary greatly. The first step should therefore be to clarify which definition you want to base your strategy on. In addition, it should be clear which challenges and problems the company is currently facing in terms of ESG. For example, for a manufacturing company, reducing waste might be high on the list.

Important questions to ask:

- What do we need to improve in terms of sustainability?

- What does success mean to us in terms of ESG targets?

- What are our competitors doing to develop sustainable business practices?

- What do our investors or stakeholders value?

- What role (e.g., pioneer) do we want to play in the public eye?

- How much time do we have to achieve our goals?

Step 2: Determine capacity

As soon as it is clear where the challenges lie, the resources available in the company for the ESG topic should be addressed. This is the only way to realistically assess what the team can achieve with what effort and in what timeframe.

Specifically, you should think about the following points:

- Human resources

- Budget

- Business environment

- Time

The financial aspect usually plays a particularly important role. Ultimately, a budget is essential in determining which sustainability goals can be achieved.

Step 3: Formulate goals and OKRs

With the requirements and resources in mind, the next step is to,

- define a framework of long-term ESG goals, and

- derive concrete Objectives and Key Results for an OKR cycle from these.

Which ESG goals should be pursued in the long term is derived from the previously defined challenges. In addition, there are some general guidelines and frameworks that can serve as guidance. Among the best-known are the Climate Disclosure Standards Board (CDSB), the Global Reporting Initiative (GRI), the International Sustainability Standards Board (ISSB) and the Carbon Disclosure Project (CDP).

Thus, the OKRs shouldn't stand alone as a strategic framework, when working with ESG. Rather, the OKRs should translate ESG requirements into near-term milestones and a concrete roadmap.

How exactly one formulates good OKRs we reveal in a separate article. This contains the most important tips and tricks for creating OKRs – including linguistic formulas that can be easily applied to each Objective and Key Result.

{{< image src="resources/esg-framework-software" alt="ESG Framework Software" bordered="true" shadow="true" max-width="100%" >}}

{{< highlight >}}

💡 Tip: Before you start creating the first ESG OKRs, it may also be helpful to take a look at our guide to OKR Planning. It explains how to best conduct an OKR planning meeting in practice – including an agenda and checklist for preparation.

{{< /highlight >}}

Step 4: Track progress

As with all OKRs, staying on top of things and tracking progress is critical to the success of ESG OKRs. To ensure that everyone on the team is working toward common goals and resources are being used efficiently, you should set up a detailed OKR reporting. Here, you can either include ESG topics in regular reporting or create a separate overview.

Smaller teams and companies that are just starting with OKRs can use a simple OKR tracking template for this purpose. The more employees the company has, the more useful OKR software like Mooncamp becomes. This makes OKR tracking and reporting much easier. For larger companies that need to keep track of many OKRs, a dedicated OKR software is even essential.

{{< image src="resources/esg-dashboard-reporting" alt="ESG Dashboard Reporting" bordered="true" shadow="true" max-width="100%" >}}

OKR examples for ESG

How the whole thing can look in practice is explained by the following examples:

🌱 Environmental OKRs

🤝 Social OKRs

📈 Governance OKRs

💡 Tip: If you want more inspiration, check out more OKR examples from a wide variety of topics. All of them are from real companies.

ESG strategy: FAQ

What is the difference between ESG and CSR?

Corporate Social Responsibility (CSR) focuses more on corporate actions towards the environment and society. The moral aspect is very much in the foreground here. ESG, on the other hand, originated in the world of finance and focuses more on the measurable factors of sustainability. Both concepts can be used simultaneously in a company.

What ESG indicators are there?

A variety of ESG key performance indicators exist. Among the most important are: Greenhouse gas emissions, water consumption, energy consumption, employee turnover, sickness rate, percentage of women in management positions, and customer satisfaction. Most ESG KPIs map risks because these play the biggest role for investors.